Federal Tax Guide for American JETs

Buckle your seat belts, boys and girls. You're in for a swell time with the IRS! Actually, filing your taxes from Japan is pretty easy once you know how to do it. Figuring out how to do it is the hard part, so I decided to make this handy guide.

PLEASE NOTE: THIS SITE HAS BEEN UPDATED TO REFLECT CHANGES IN THE TAX TREATY BETWEEN THE US AND JAPAN. PLEASE READ THE SECTION ON FORM 8802 EVEN IF YOU HAVE ALREADY DONE SO IN THE LAST WEEK. THESE CHANGES ARE NOW KNOWN TO AFFECT ALL JETS. LAST UPDATED JUNE 17, 2005.

Please also check out the new FAQ and updated Other Resources!

Preface

Farting around on the IRS website will take you to information for US taxpayers living abroad. [2004 Link]

You're in for a swell time with the IRS!

I want to add that this guide includes links to a lot of websites; though the pages where the information is located may change from year to year, the gist is the same. All of the information presented in this guide was found on the IRS website (after some major headaches, mind you) and it can be found again. My general approach to the IRS site is to go to information for Individuals and look for links for international taxpayers from there.

"I recommend poking around the IRS website first."

If you have any problems or questions, don't get your panties in a bunch. I recommend poking around the IRS website first. There's a lot of useful information on there, and you can always email the IRS with questions and they'll get back to you. Sometimes it may take a while to find things, but the answers are there.

Once you have filed your federal forms, it should be a piece of cake to file your state taxes. (I was able to print all the forms I needed online and the Ohio IRS was very helpful via email when I had questions.) I won't address the state tax issue here because each state is different. Suffice to say, yes, you have to file state taxes. Please don't email me asking about your state.

Ok, onto the Nitty Gritty (tm).

Getting Started

This guide is largely addressed to 1st year JETs who had income in the US for part of the year. I write it from this perspective because it's the most inclusive one. If you are a second year JET or a first year JET who did not have income in the US before coming to Japan, just weed out the parts you don't need.

You should have received the book titled "Forms and Instructions for Overseas Filers." If not, call the IRS and ask for one. Alternatively, you can download the forms you need online, but the book is handy. (Note: if you go to the IRS site and find the form there, you can fill it out using Adobe Acrobat Reader and save it on your hard drive--very handy!)

You cannot file form 1040 EZ, and Telefile is thus useless. But it's not the end of the world!

Forms you need:

- 8802

- 4868

- 1040

- 2555-EZ

- Pub. 970 from the IRS website, the student loan interest deduction portion (only if you've paid deductable interest on student loans in the last year)

First things first

Form 8802*

Before you do anything else--and I mean don't even blow your nose--file form 8802. This is a new requirement that started in 2004 and it concerns the tax agreement between Japan and America. Please note that even JETs who arrived in 2003 and earlier are also required to file this form! Apparently all JETs are now required annually to file an application for United States Residency Certification. The resulting certificate will prove that you are a US resident and are therefore exempt from paying Japanese taxes. If you do not file this form, your contracting organization will be required to pay the taxes for you--something like 20% of your annual salary. So be nice to your town and just fill out the dang form!

"...[J]ust fill out the dang form! Start as early as possible!"

Once you've filled out Form 8802, send it into the IRS. You should get a confirmation saying that they've received your application and that you'll have a response within 30 days. (This confirmation sheet also includes a helpful phone number in case you don't get a reply: 1-215-516-2000.) In 30 days, if you're lucky and God loves you, you should get Form 6166 in the mail--this is your certificate of US residence. Make yourself a copy (you can also request multiple copies of it from the IRS) and then give the form to your supervisor so they can turn it in. If any of the steps in this process fail, call the IRS at 1-215-516-2000. This certificate must be turned into the Japanese government by the last day of June--start as early as possible because the process could take anywhere from 60 days to four months (!) from the time they recieve your application, and that's without any hitches!

(Luckily, this looks like an easy form to fill out. If enough people bug me, I may be persuaded to write a guide for it as well. You can also call the JET Line if you run into any problems: 03-3592-5489, M-F 09:00-17:45. CLAIR also has an official guide to these forms here.)

P.S. Disregard the date on Form 8802 as it is not updated annually like other tax forms.

P.P.S. I was informed recently by my office that even as a second-year JET who arrived in 2003, I must also turn in Form 6166. This is contrary to the information given to me by my Board of Education at the Mid-Year Conference. So please talk to your office about this if they have not yet approached you! Due to the misunderstanding, they are allowing me as much time as I need to turn in the form.

Form 4868

Before you begin, photocopy the form that the school gave you showing how much money you made last year. Indicate your name and your gross income on the photocopy and write Foreign Earned Income Statement across the top. This will act as a W-2 for income earned in Japan.

Next, file form 4868 by April 15th and sit on your butt for a while. You can't file federal taxes until you've been in Japan for 330 days. There are other extension forms you can file, but this one gives you the maximum amount of time and is the easiest to file. Although you already have an automatic 2 month extension as a US citizen living abroad (as long as you've filed a change of address with the IRS), it's not usually enough for you to have been in Japan 330 days before filing. Group C JETs may need to use Form 2350 depending on when they arrived in Japan.

"If you owe any taxes, you must pay at least an estimated amount when you file for the extension!"

Be sure to check with your state IRS; in most cases, a federal extension automatically includes a state extension; you just have to include a copy of the federal form 4868 that you filed when you file your state returns.

Once you've been in Japan for 330 days, you can send in the following forms. You'll probably need to do some of this before you file form 4868 to determine how much tax you owe, if any. If you owe any taxes, you must pay at least an estimated amount when you file for the extension!

Form 2555-EZ

Fill out 2555-EZ next. In most cases, you will fail the Bona Fide residence test, but pass the Physical Presence and Tax Home tests. The physical presence test is based on a 365-day period from the time you arrive in Japan.

Fill in your address and employment information; you can write N/A for Employer's US address. Your employer is "other"--I put "a foreign board of education." Follow the instructions until you get to the part that asks what your tax homes were during the tax year. In this blank, write in ALL addresses at which you were taxed during the last year, including home, college, apartment, Japan, etc. and the dates you lived there. Make sure the whole year is covered. Month to month is enough--you don't need to specify the exact day you moved.

Under Days Present in the US, fill in any time you spent in the US during the 365-day period you specified under the Physical Presence Test. Put each trip on a new line. In my case, I spent the first half of the year in the US and did not return home after that, so I only have one line that has N/A for "date arrived in the US", the date I left for Japan for "date left US" and 0 for "# days in US on business" and "income earned in US."

"The IRS likes everything you do to be outlined explicitly."

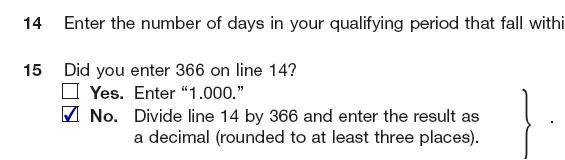

Now onto Figuring your Foreign Earned Income Exclusion. Where it asks for the number of days in your qualifying period that fall in the last year, just enter the number of days out of the 365-day period you entered under Physical Presence Test that fell within the last tax year. It will be around 150-160. Follow the rest of the instructions. When you get to "Enter, in US dollars, the total foreign earned income...for the tax year...", I put in the amount listed on my makeshift foreign earned income statement converted to USD, and also wrote an asterisk under the line with "see foreign earned income statement." Then I wrote a note at the bottom: "I used the (year) average Yen/USD exchange rate as reported by (we'll get to this) to calculate the amount reported on line 17. That rate was $1 = (#) Yen." Then I signed my name to it. The IRS likes everything you do to be outlined explicitly. So, even if you make a mistake, if you've outlined (read: covered your ass) beforehand with lots of comments explaining what you do, then they'll be less likely to go after you and more likely to let you correct any mistakes.

As for determining the exchange rate, you can find links to various rates on the IRS website, under the same section mentioned above for US citizens living abroad. [2004 Link] But what you really want is the average, and the best place to get that is the Federal Reserve Bank (also linked on the above page). [2004 Link] Find the link for foreign exchange rates: annual. Click on the document labeled "current release" and look for Japan and the current year. This is the exchange rate you should use to calculate your foreign earned income in USD.

Finish the last part of the 2555-EZ.

Deductable Interest on Student Loans

If you paid deductable interest on student loans in the last year, fill out the Student Loan Interest Deduction Worksheet from Publication 970. Use this form instead of the one that comes with form 1040.

Form 1040, the Big Pimp Daddy

We're on the home stretch, kiddies. Grab a cup of coffee and a couple of ibuprofen. I pity da fool with other schedules and deductions. Sorry, but this guide won't address those because I've never had to use them. For the most part, JETs are exempt from the moving expenses deductions and such, so don't bother with those unless you have to.

We're on the home stretch, kiddies.

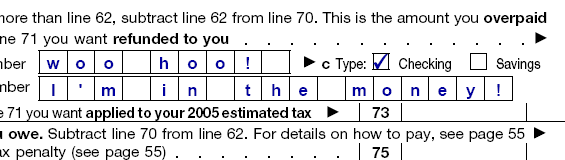

Ok, start at the top and work your way down. Claim yourself as an exemption. For wages, salaries, and tips, enter the grand total--including all W-2s and your income from Japan. Taxable interest includes all interest earned from savings accounts; don't forget to add that. Hopefully for you, everything is zeroes until you get to line 21, "Other Income." List your Japan-earned income on that line, in parentheses, and write 2555-EZ next to it. Add your wages and taxable interest, then subtract the Japan-earned income and enter the total on line 22 (total income). This total is the amount of taxable income you earned in the US during the tax year.

If you paid student loan interest, enter the amount of the student loan interest deduction from the worksheet in publication 970 where it says (amazingly enough) "student loan interest deduction." Ignore the "see page #" part. Finish following the instructions for the rest of that section and turn to the next page.

"It's a good idea to skim the complicated stuff in the instructions anyway, just to be sure you don't miss something."

Everything should be straightforward for the back page because by the time you get there, you've dealt with all the foreign earned stuff and weeded it out. My rule of thumb when filing taxes is, "If I haven't heard of it, then it probably doesn't apply to me." It's a good idea to skim the complicated stuff in the instructions anyway, just to be sure you don't miss something. If you feel uncertain about anything, you can email the IRS on their site or include a signed and dated note to that effect. Then if you've made a mistake, they won't get all auditing on your ass.

I designated my mother as a third-party in case the IRS needed to discuss my return and I was unavailable.

Once you've finished all these forms and been in Japan for 330 days, you can mail your return into the IRS. Hooray! That wasn't SO bad, now was it?

Frequently Asked Questions

Should I file both the change of address form and Form 4868?

You do not need to file both forms. Filing a change of address automatically gets you a 2 month extension, but this is not long enough for most first year JETS. If you are a first year JET, file Form 4868; it includes a change of address as well.

Why is the percentage on line 15 of your example Form 2555-EZ incorrect?

I assume you mean the image that shows only part 4 with the note at the bottom. I made this guide while in my second year and accidentally put the percentage from my own form on there instead of the percentage from my first year form. I fixed it on the actual .pdf file, but couldn't be bothered to print screen and mess with Paint again. Maybe one day I'll fix it, but probably not. You'll still have to calculate your own percentage anyway, and the point of that image is really the note at the bottom.

If I am exempt from Japanese taxes, do I have to pay American taxes? Can I really escape taxes in both countries?

It is my understanding that, prior to 2004, the Contracting Organization was required to pay Japanese taxes for all American JETS. Due to changes in the tax treaty, and--no doubt--a lot of bureaucracy, we are now required to submit Form 6166 (see the section on Form 8802) to the Japanese government. This proves that we were tax-paying residents of the US prior to coming to Japan and that we continue to file US tax forms; thus, we can claim exemption from Japanese taxes. This means that that your Contracting Organization no longer has to pay those taxes, giving them more money for good things, like education.

The flip side of this is that, as an American citizen living abroad for more than 330 days of the year in question, you do not have to pay taxes on foreign-earned income below $80,000 annually. Thus, you do not have to pay either Japanese taxes or American taxes on your JET income. In order to claim this exemption, you must file Form 2555-EZ or Form 2555 when you file your taxes. You will be taxed by the US IRS, however, on any income earned while living in America--including interest on savings accounts and income earned while working a portion of the year before or after JET.

If I do not file Form 8802, what will happen? My office says I'll have to pay the taxes myself.

This is not true according to CLAIR. If you do not file the form, your office will have to pay the taxes for you according to your JET contract. If they try to force you to pay, please call the JET Line: 03-3592-5489, M-F 09:00-17:45. Ideally, just file Form 8802 in November of the tax year to make sure you get it on time.

I did not file Form 8802, what will happen? My office has said nothing about it.

If you arrived in 2003 or earlier, you still probably need to file Form 8802. I arrived in 2003 and was not informed until June 15 that I needed to file that form. If you have not heard from them already, please ask your Contracting Organization about it ASAP. I was informed mistakenly by my Board of Education, as was my Supervisor, that I did not need to file it! Luckily, the tax office has agreed to give me extra time to file Form 6166.

If you arrived in 2004 or later, you need to get on top of this yesterday. Please contact your Contracting Organization about it ASAP.

Form 8802? Form 6166? WTF?

You file Form 8802 with the US IRS and recieve Form 6166 from the US IRS in return. Form 6166 must be turned into your Contracting Organization to exempt you from Japanese taxes. Please see this section for more information.

Other Resources

American JET Tax Overview from Saitama Prefecture

Official CLAIR Guide to Forms 8802 and 6166

Tochigi AJET Guide to Forms 8802 and 6166

The US Embassy in Japan's Tax Page

List of Tax Preparers in Japan, from US Embassy

Information on Requesting a Copy of Last Year's Tax Return

*I would like to give special thanks to tall girl Liz Yeager for her information about Form 8802 and its spawn, Form 6166.

I would also like to thank everyone who has submitted information, corrections, and questions to me concerning this page. You've been indispensible and have helped to make it worlds better!